W2 withholding calculator

South Carolina Department of Revenue. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Direct Deposit Pay Stub Template Free Download Template Printable Payroll Template Word Template

Complete e-File or Print Tax Forms Instantly.

. Referred client must have taxes prepared by 4102018. Complete a new Form W-4 Employees. Divide line 1 by line 2.

Taxpayers who withhold 15000 or more per quarter or who make 24 or more withholding. For example if an employee earns 1500. Ad 1 Use Our W-2 Calculator To Fill Out Form.

Ad Access IRS Tax Forms. Ad 1 Use Our W-2 Calculator To Fill Out Form. The maximum an employee will pay in 2022 is 911400.

Ad 1 Use Our W-2 Calculator To Fill Out Form. Because of the numerous taxes withheld and the differing rates it can be tough to figure out how much youll take home. Subtract line 5 from line 4.

Divide line 6 by line 7. The Cumulative Average Method in computing withholding taxes where the total supplementary compensation is equal or greater than the total regular compensation cannot be. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

For help with your withholding you may use the Tax Withholding Estimator. Tax withholding is the. Use this calculator to help you complete Wisconsin Form WT-4 Employees Wisconsin Withholding Exemption CertificateNew Hire Reporting.

How to calculate annual income. Edit Sign and Print IRS W-2 Tax Form on Any Device with USLegalForms. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

2 File Online Print - 100 Free. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Use that information to update your income tax withholding elections.

HR Block employees including Tax Professionals are excluded from participating. The IRS hosts a withholding calculator online tool which can be found on their website. Please visit our State of Emergency Tax Relief page for.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. This is wages per paycheck. To change your tax withholding use the results from the Withholding Estimator to determine if you should.

You can use the Tax Withholding. Change Your Withholding. Ad Use Our W-2 Calculator To Fill Out Form.

2 File Online Print - 100 Free. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Available at participating offices and if your.

2 File Online Print - 100 Free. Balance of withholding for the calendar year. File Online Print - 100 Free.

The information you give your employer on Form W4. To use the Withholding Calculator most effectively taxpayers should have a copy of the 2018 tax return due earlier this year as well as recent paystubs for themselves and their. Columbia SC 29214- 0400.

Thats where our paycheck calculator comes in. Businesses impacted by recent California fires may qualify for extensions tax relief and more. In order for the changes in your withholding to take place you must complete a W-4 form and submit the form to Payroll and Employee Services NEL 244.

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Online Broker

Tax Withholding Calculator For Employers Online Taxes Federal Income Tax Tax

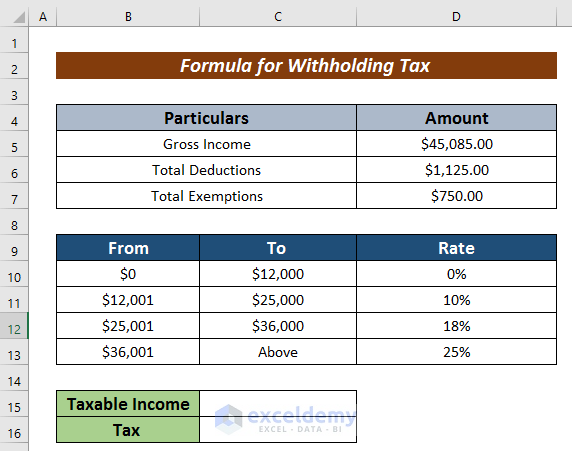

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Federal Income Tax Fit Payroll Tax Calculation Youtube

Infographic How To Calculate Payroll Infographic Design Infographic Infographic Inspiration

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Pin On Buy High Quality Real Fake Passports Drivers License Id Cards Counterfeits Bank Notes Etc

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How To Calculate Federal Income Tax

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Free Income Tax Calculator Estimate Your Taxes Smartasset Income Tax Income Tax

Tax Withholding Internal Revenue Service Internal Revenue Service Tax Federal Income Tax

Generate Your Paystubs In 30 Sec Or Less Free Preview Statement Of Earnings Payroll Template Cigarette Coupons Free Printable

How To Calculate Federal Withholding Tax Youtube

Pay Stub Preview Payroll Template Money Template Good Essay